“The World’s Largest Casino” Meme Coins Are Reshaping Crypto’s Future

Billions in Play: The Rise of Meme Coins

Once fringe novelties, meme coins have surged to the forefront of crypto, driving speculative mania and redefining investor behavior. Platforms like Pump.fun, a Solana-based launchpad, have enabled the creation of over six million meme tokens since January 2024 — most with no use case beyond trading hype.

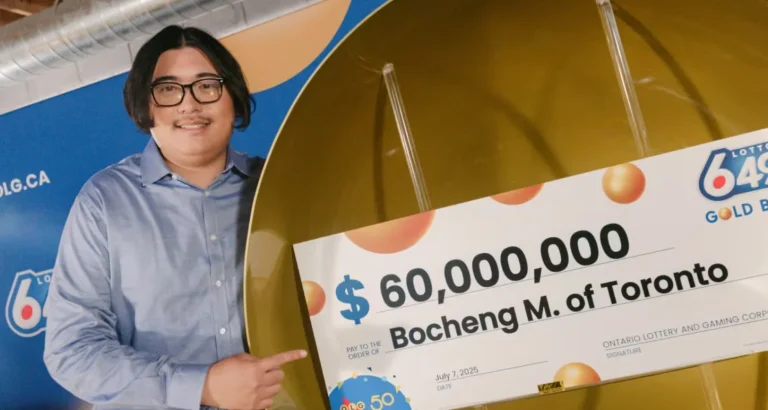

Political leaders are now entangled in the chaos. In Argentina, President Javier Milei was linked to the LIBRE token, which skyrocketed before crashing within hours — a collapse that ignited a political uproar and impeachment calls. In the U.S., Donald Trump’s meme coin, Official Trump, briefly hit a $15 billion market cap before falling back to $3.35 billion. Even Melania Trump joined the trend with her Melania Meme token.

With billions in retail funds pouring into tokens lacking utility, experts are asking: are meme coins just draining liquidity and undermining innovation, or are they the entry point for millions into digital assets?

Liquidity Drain or Onboarding Tool?

Meme coin defenders argue they lower the barrier to entry and bring new users into crypto without requiring deep technical knowledge.

Daria Morgen, Head of Research at Changelly, believes meme coins don’t divert capital from serious projects. “Most meme coin traders wouldn’t have invested in blockchain protocols anyway. It’s a free market — serious projects must compete for attention and liquidity,” she said.

Others disagree. Tobin Kuo, CEO of Seraph Studios, said the frenzy has hurt long-term development, particularly in GameFi. “We’re building complex ecosystems with NFT-based economies, but traders are now focused on short-term flips. It’s hard to maintain engagement when everyone’s chasing meme coin gains.”

Jessica Zheng, CEO of Cycle Network, acknowledges both sides: “Meme coins started as grassroots resistance against institutional dominance. But now, they’ve encouraged a short-term mindset. The focus on fast profits has weakened long-term innovation.”

Georgii Verbitskii, founder of TYMIO, believes meme coins are actively delaying the broader altcoin bull run. “They’re sucking liquidity away from solid projects. Thousands launch daily, and many investors are choosing hype over fundamentals.”

Pump.fun and the Democratization of Hype

Platforms like Pump.fun have made token creation frictionless. While this aligns with decentralization principles — open access and low barriers — it has also enabled a tidal wave of speculative coins.

Morgen sees both opportunity and danger: “Pump.fun has lowered entry barriers, but also created fertile ground for scams. Retail traders are often the victims of pump-and-dump cycles.”

Kuo is blunt: “Crypto is becoming the world’s biggest casino. These platforms aren’t fostering innovation — they’re gamifying speculation.”

Zheng adds: “Speed doesn’t equal sustainability. Zero-barrier tools like Pump.fun can amplify good ideas — but they amplify bad ones too. If there’s no substance, it’s just hype.”

The real issue, experts agree, is how these platforms are used — often to launch tokens marketed as quick-profit bets by influencers, only to collapse shortly after.

Who’s Fueling the Frenzy?

From influencers to exchanges, many actors profit from meme coin mania. But when the tokens crash, who’s accountable?

Morgen insists on the need for education: “This is a free market, but influencers and platforms must act responsibly. Promoting low-quality tokens for short-term gain damages trust.”

Kuo counters: “Calling this a ‘free market’ is misleading when content is driven by paid shills and manipulation. Retail investors are following hype, not research.”

Zheng takes a balanced view: “Platforms and influencers shape sentiment. If they prioritize engagement over responsibility, it’s retail investors who pay the price.”

Mori Xu, co-founder of Tabi Chain, calls for industry self-regulation. “There needs to be more transparency — influencers should disclose paid promotions, and platforms should implement risk warnings.”

Verbitskii believes losses will eventually teach investors caution. “When enough people lose money, the hype will slow. Painful cycles are part of how markets mature.”

Why Traders Keep Coming Back

Despite repeated crashes, meme coins continue to attract billions. Why?

Kuo compares the trend to historical financial manias: “This is the Bandwagon Effect. People buy because others are making money — not because of fundamentals.”

Xu says the shift is deeper. “We’re moving from fundamentals-based investing to narrative-driven speculation. Communities and social media hype now drive markets.”

Morgen sees it as part of crypto’s dual nature. “There are always two camps — long-term investors and short-term speculators. Meme coins simply appeal to the latter.”

The LIBRE Scandal: A Turning Point?

The LIBRE collapse, linked to Argentina’s president, caused millions in losses and pushed meme coins into global political discourse. It reignited the debate over regulation.

Kuo is skeptical that regulation will work: “If you regulate Pump.fun, another platform will emerge. That’s the nature of decentralization.”

Zheng sees room for smart rules: “Unregulated hype hurts retail. Some safeguards — like requiring identity verification — could help.”

Xu supports balanced intervention: “Governments should protect investors but avoid stifling decentralization. Transparency and security audits could reduce manipulation.”

At Davos 2025, meme coins were a major discussion topic. Hedi Navazan, Chief Compliance Officer at 1inch Labs, warned of manipulation and misuse by public figures. “Meme coins risk turning crypto into a spectacle, distracting from real innovation.”

Verbitskii predicts the peak of the mania may be behind us. “The Trump token might’ve marked the top. Many retail buyers are left with losses, and sentiment is shifting.”

Still, history suggests the cycle will repeat. Political tokens, celebrity coins, and AI-generated memes are already emerging.

Conclusion: What’s Next for Meme Coins?

For now, crypto remains a high-risk, high-reward landscape — and meme coins are its loudest expression. Whether the future brings regulation or market-driven corrections, the next chapter will be defined by how the industry responds to this speculative wave.